$44,326profit.

$133,758profit.

He learned how to leverage $300k in On-Demand funding at 0% interest.

Want the FULL playbook? Get this FREE Training

$133,758profit.

He learned how to leverage $300k in On-Demand funding at 0% interest.

Want the FULL playbook?

Get this FREE Training

Apply

Fill out this simple application

Consultation

1-on-1 business consultantion

Funding

Funding as soon as 7 days

StartupFundingApplication

- (844) 220-8826

- info@midwestcorporatecredit.com

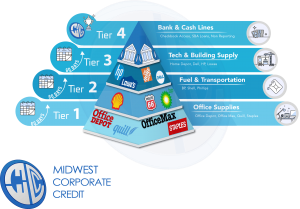

Building Business Credit

Just like your personal credit profile and score, your business has it’s own credit profile and score. This infographic breaks down the different tiers in building your company’s credit profile.

When your business has little or no credit, you will want to start small. Think back to when you were in your early 20’s and had no personal credit. You probably started off with store cards with low limits. Perhaps a $300 Macy’s card. After a few months of on time payment history on this account, perhaps you were offered a higher limit on this card or another card with a different retailer. A few months later, you upgraded to secure bank credit card. Once these 3-4 accounts built your credit score, you were offered an unsecured Visa or Mastercard with a small limit. Then you got your first car loan. Then eventually your first mortgage.

Building Business credit is no different than the process you used to build your personal credit. Just like any other endeavor, there are short cuts to building your business credit. This roadmap will guide you in building a solid business credit profile within 6-8 months.

Tier 1:

Office Supply

During this phase, you will pour the foundation of your business credit profile. No; pouring the foundation is not as fun as putting on the finishing touches but it is a necessary step. You start with small dollar store cards during this phase. Apply and get approved for 2-3 of these. Use the accounts for 2 months and move onto tier 2 accounts.

Tier 2:

Fuel cards

Once your tier 1 accounts have reported for 2 months, apply for 2-3 tier 2 accounts. Use these for 2 months and move onto tier 3.

Tier 3:

Contractor Supply & Tech

These accounts are harder to get approved for than the first two tiers. You will get denials. Do not let this discourage you. If you get declined, wait another 2 months and reapply. Get approved for and use them for 2-3 months and move on to tier 4.

Tier 4:

Bank Credit Cards & Checkbook Lines

Why is this section blank? Because this is where it gets tricky. A one-size-fits-all solution does not exist with tier 4 credit. Tier 4 is bank credit cards and other bank financing. This tier will require a personal guarantee. There are a lot of factors that come into play. Factors such as:

- Which credit bureau will the lender inquire credit from?

- Will the account you’re applying for report to your personal credit?

- Will the amount of inquiries you already have automatically get you declined?

- Is the bank you’re applying with a true commercial bank?

- Will the account you’re applying for have any benefit to your business credit?

There proper technique that leads to success in this tier is different in every state in the United States. Midwest Corporate Credit specializes in guiding clients through the mine field of tier 4 financing. Apply today to see if you qualify to have us set up your tier 4 accounts!

Did you like this article?

We provide more case studies and finance tips weekly, but you won’t know when we do unless you complete one of the steps below!

- Subscribe to the Midwest Corporate Credit Newsletter

- Subscribe to our Youtube Channel

- Like our Facebook Page

$44,326profit.

$133,758profit.

He learned how to leverage $300k in On-Demand funding at 0% interest.

Want the FULL playbook? Get this FREE Training

$44,326profit.

$133,758profit.

He learned how to leverage $300k in On-Demand funding at 0% interest.

Want the FULL playbook?

Get this FREE Training

2 thoughts on “Building Business Credit”

Does your business have to show income before getting approved for the checkbook business lines of credit?

Hi Winston,

Yes, your business must have at least two years of operating history, as well as documented income to be approved for a business checkbook line of credit. Don’t let the attractiveness of a physical checkbook blind you to the other great funding options your business can leverage for massive growth! If your business is pre-revenue, then our Startup Funding Program is a great option for you, and you’ll find that you can use the funding just as conveniently as you would an actual checkbook.

I’d be happy to send you more information on both programs, or schedule a time for one of our Business Growth Consultants to speak with you about your funding options.

–Dan